Content

- Introduce project accounting to your business

- Cost Accounting Helps Businesses Accurately Ascertain Costs

- The Benefits of Cost Accounting in Project Management

- Project-based accounting best practices

- Project Accounting Benefits

- What to Include in a Project Accounting Annual Report

- Project accounting vs. cost accounting

Creating a consistent structure allows for better overall measurement of your organization. A project profitability analysis is an analytical construct that can be easily achieved using project accounting software. A project profitability analysis compares the revenue generated by doing work for a customer vs. the cost to the organization for delivering the services. Project accounting includes documenting the date legal agreements are signed with a customer, tracking earned revenues from sales agreements and identifying the costs related to each project phase. In short, project accounting follows the money from the project plan through execution with detailed documentation and adjustments to help you stick to your budget. To do this, a project accounting plan must be created during the project planning phase.

- For example, if you don’t have enough staff to meet the deadline, you have to accept that limitation and factor it into your projections.

- It concerns even PMI’s top performers, as 33% of their projects also end up in some form of scope creep.

- The budget set for that category should then be allocated toward each task.

- Accountants should set this method up carefully to measure the appropriate figures.

- Once a project has been designated the lowest level

project for a node, further cycling through this screen will create projects at

the same level as the lowest level project just created. - General accounting deals with all financial transactions of the entire business, while project accounting reviews only project-related transactions.

Companies use job order costing to track direct materials, direct labor, and manufacturing overhead. In addition to changes in productivities, other components of the estimating formula

can be adjusted or more detailed estimates substituted. For example, the change in unit

prices due to new labor contracts or material supplier’s prices might be reflected in

estimating future expenditures. The only exception to this rule is the danger of quality problems in completed

work which would require re-construction. Another key difference between project accounting and regular accounting is the level of detail. Project accounting often involves tracking costs at a very granular level, such as tracking the cost of individual materials or labor hours.

Introduce project accounting to your business

Both professionals and students can take project accounting training formally or informally. There are many courses offered on the principles and methods, both standard accounting courses and specialty ones. Small businesses should look for software with an affordable price tag and various pricing plans. Integration with other software systems should also be an option and compatible with existing tools.

What is project cost accounting?

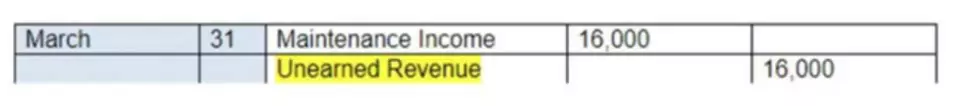

Project accounting, also known as project cost accounting or project based accounting, is a type of accrual accounting that measures revenue, cost, and profitability of a project or portfolio of projects.

With an advanced cloud-based, mobile-ready solution like Replicon, project accountants can rest easy by letting the tool do the heavy lifting for them. To streamline project accounting in your organization, the right project accounting software is a must. These tools can help track all details of the project including estimates, bids, purchase orders, billing, change orders, resource costs, time costs and more.

Cost Accounting Helps Businesses Accurately Ascertain Costs

Budget forecasting should be a part of any successful project planning process. Complete this step before the project begins so you have a basis for measuring progress, recognizing potential problems, and determining whether the project benefits outweigh your cost. During the course of the project, you will also need to process every transaction, track financial commitments and revenue recognition, run billing and invoicing, and generate profitability reports. With project accounting, you can attribute cost and revenue to individual projects, making it easier to see how each is progressing. However, this method goes beyond profit and loss statements by identifying sources of revenue and costs—helping you not only track profit, but also giving you clarity on how profit was earned. You can use project-based accounting to spot scope creep like this in its early stages.

- The rule of thumb is that successful project managers and accountants make sure that projects are delivered against promised budgets.

- A well integrated ERP software such as Acumatica has the goal of not only streamlining business processes, but also allocating resources in a way that’s more efficient and cost-effective.

- This Wrap Rate value is important to the project manager, since this cost is subtracted from the revenue generated from the external customer.

- Any project more complicated than buying lunch will probably develop unplanned problems, needs, and expenses.

Generally accepted accounting principles (GAAP) require accountants to perform revenue recognition (acknowledging income) consistently and according to an approved methodology. If your company could benefit from better costs, expenses, and revenue management, it may be time to give project accounting a try. Project-based accounting is a lot more detailed than your organization’s typical financial accounting process. It’s good practice to manage these projects in their own separate financial accounts. This will also help you easily organize and access the information needed for individual projects.

The Benefits of Cost Accounting in Project Management

It concerns even PMI’s top performers, as 33% of their projects also end up in some form of scope creep. When projects enter this stage, project accountants would benefit from active numbers that don’t lie. A sharp and notable contrast between the two, according to Elizabeth Harrin, is that project accounting has start and end dates that correspond to the days your project should start and finish. While project accounting is tied to the project scope, financial accounting is based on periods in a financial year, that differ from business to business, as they depend on the start day of the company. The visibility offered by project accounting also enables the ability to make informed data-driven decisions. As all financial metrics are monitored, it becomes easier to make course corrections as the project progresses and the data will tell you exactly where you have to make those changes.

However, implementing project accounting as a standard part of the process can actually help streamline project management. By tracking project costs, you’ll also be more likely to stay within the budget. What’s more, you can catch any overspending before it becomes a major issue.

Project-based accounting best practices

Financial accounting is the cold hard facts that get reported externally to auditors. They all work off the same foundation, they are just used in different situations to accomplish different tasks. The importance of project accounting is clear; cost is one-third of the triple constraint and managing those finances is key to delivering a successful project. Knowing how much you’re spending will help you keep to your budget, therefore, understanding the workflow of your costs is crucial to controlling them. With cost accounting, you can thoroughly evaluate all strategies within your business, including cost-volume-profit analysis, investment appraisals, level of production and the profitability of products. This can improve decision-making abilities, as financial decisions will be driven by accurate assessments of all financial influences.

However, certain

segments of project activities can profit tremendously from this type of organization. Materials involve only a

subset of all cost accounts and project activities, so the burden of data collection and

control is much smaller than for an entire system. Consequently, materials control systems can reasonably encompass a “work

element” accounting project accounting system. For control and monitoring purposes, the original detailed cost estimate is typically

converted to a project budget, and the project budget is used subsequently as a

guide for management. Expenses incurred during the course of a project are recorded in specific job

cost accounts to be compared with the original cost estimates in each category.

Project Accounting Benefits

For example, when projects fall behind, more manpower is often necessary to bring the project current. Accountants will therefore allocate more direct labor costs to the project, increasing the total overall project costs. External reports are constrained to particular forms and procedures by contractual

reporting requirements or by generally accepted accounting practices. https://www.bookstime.com/articles/accounting-for-churches Preparation of such

external reports is referred to as financial accounting. In contrast, cost

or managerial accounting is intended to aid internal managers in their

responsibilities of planning, monitoring and control. In addition to cost amounts, information on material quantities and labor inputs within

each job account is also typically retained in the project budget.

- And on top of all their other duties, it may not be realistic to expect them to complete project accounting manually.

- All this results in lower business costs, a good return on their software investment and happier clients.

- In general accounting, you can simply compare expenses from a previous period with those in the current period.

- Your forecast says the project will use $50,000 of ore each month, but after two months the team has only ordered $25,000 of ore.

- The difference between project-based accounting and general financial accounting is granularity.

By learning the answers to similar questions, you gain a better insight into the ways you can improve the financial performance of projects. Overall, project accounting allows for a better understanding of project profitability. While project managers implicitly recognize the inter-play between time and cost on

projects, it is rare to find effective project control systems which include both

elements. Usually, project costs and schedules are recorded and reported by separate

application programs.

Journal entries for project accounting only track them for the current project. Project-based accounting focuses on the budgets and expenses tied to specific projects. You can apply project accounting to anything from attending a trade show to bringing your newest product to market. Project accounting is an essential tool to prevent time and budgets from slipping out of control.

The Supply Side of Decarbonization by Ricardo Hausmann – Project Syndicate

The Supply Side of Decarbonization by Ricardo Hausmann.

Posted: Tue, 30 May 2023 12:20:00 GMT [source]