Contents:

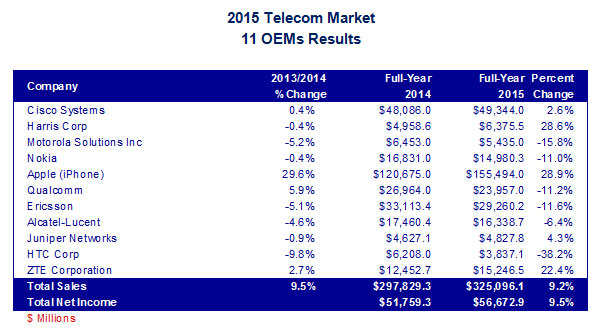

The stock market rally had a quiet Tuesday, though the major indexes nudged into record highs intraday. Lyft stock,Enphase Energy,Match Group and Dow giantCisco Systems were notable movers after hours. In Q1 2018, United States generated revenue of $43.13 million, but in the span of 3 years, the revenue increased by around 4 times for the same. If a user or application submits more than 10 requests per second, further requests from the IP address may be limited for a brief period.

Note that this policy may change as the SEC manages SEC.gov to ensure that the website performs efficiently and remains available to all users. The ETF with the greatest exposure to Enphase Energy’s stock is the Virtus Duff & Phelps Clean Energy ETF , according to etf.com. As of 7 February, Enphase is VCLN’s top holding, with an 8.16% weighting VCLN gained 11.6% over the past 12 months and 3.5% in the year to date. Enphase also reported that global demand for its products and the incentives provided by the IRA have been boosting the company’s manufacturing capacity within the US. In addition to increasing output with two existing partners later in 2023, a new manufacturing partner is slated to begin production during Q2.

From Lucid to ChargePoint — 3 Renewable Growth Stocks Worth … – The Motley Fool

From Lucid to ChargePoint — 3 Renewable Growth Stocks Worth ….

Posted: Fri, 23 Dec 2022 08:00:00 GMT [source]

Enphase Energy , the world’s leading supplier of microinverter-based solar and battery systems, announced Thursday its latest innovation – a bi-directional EV charger. The technology allows EVs to power your home during an outage or support the grid during peak demand. The price-earnings ratio is a company’s share price to the company’s Earnings per Share.

Even larger amounts of data and mind-bogglingly complex data computing techniques have meant data storage methods have had to evolve at a breakneck pace. Cloud Computing seemed to be the easy answer as companies worked to decouple their technology needs from the limited resources they had at their disposal. These are the ten S&P 500 companies that have delivered substantial capital gains over the past year and would likely lag the broader market if Biden’s capital gains tax hike is enacted, according to Goldman Sachs. The material is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is financial, investment or other advice on which reliance should be placed.

These EV Stocks will give you a good return if you BUY NOW!

They made merry as Microsoft shares surged and its market cap of $2.42T came within a hair’s breadth of Apple’s $2.46T, a difference of just $40B. The Windows now seems open for Microsoft to take back the mantle that it had recently relinquished since mid-2020. In Q2, the company expects to surpass $50B in revenue – a first in its history. Despite these stellar results, Microsoft has issued a warning for the unlikeliest of businesses – Advertising!

This information is not an individual investment recommendation, reflects only the personal opinion of the author, cannot serve as a guide for investing in any financial instruments and be their advertisement. Take your analysis to the next level with our full suite of features, known and used by millions throughout the trading world. Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment. Yes, you can purchase fractional shares of Enphase Energy, Inc. or any other US company shares in Angel One for any dollar amount. “We appreciate the CMA’s rigorous and thorough evaluation of the evidence and welcome its updated provisional findings,” a Microsoft spokesperson said. Microsoft Corp.’s chances of winning antitrust approval for its $69 billion takeover of Activision Blizzard Inc. got a boost after UK regulators narrowed the scope of their probe to focus solely on cloud gaming.

7 Growth Stocks Sitting in a Sweet Spot – InvestorPlace

7 Growth Stocks Sitting in a Sweet Spot.

Posted: Wed, 15 Mar 2023 07:00:00 GMT [source]

We are not intended to be a substitute for legal, tax or financial advice. Accordingly, customers are expected to undertake their own due diligence in consultation with their advisors and are advised not to solely rely on the Information. The services provided by WAI are non-advised however; WAI may facilitate providing you with required advice through eligible third-party providers. Customers may choose to avail the services of certain third-party service providers and will be bound by the terms, conditions, and privacy policies (T&C and Policies) of such Partners while using their services. WAI recommends that the T&C and Policies must be reviewed independently by the customers. The content of this article has been created and published by Winvesta India Technologies Pvt.

Businesses rush to install electric vehicle charging to keep tourists coming back – EQ Mag

Days before the earnings announcement, Enphase successfully demonstrated its bidirectional electric vehicle charger, a device for enabling vehicle-to-home and vehicle-to-grid charging. Enphase said it was working to make the charger available by 2024 with management confident that residential power storage solutions had the potential to protect customers from rising energy prices in the long term. Enphase Energy Inc share price live 164.20, this page displays NASDAQ ENPH stock exchange data. View the ENPH premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Enphase Energy Inc real time stock price chart below. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the ENPH quote.

Jim Cramer predicts these 10 S&P 500 stocks will perform well in 2023 – CNBC

Jim Cramer predicts these 10 S&P 500 stocks will perform well in 2023.

Posted: Wed, 04 Jan 2023 08:00:00 GMT [source]

We can deliver the https://1investing.in/ Forecasting Models For Enphase Energy Inc ENPH Stock speedily without the hassle of shipping, customs or duties. As on 1st May 2023, the P/E ratio for Enphase Energy, Inc. shares is 48.29. Yes, you can buy fractional shares of Enphase Energy, Inc. with Scripbox. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND. Please note that by submitting the above-mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND.

The company’s proprietary technology collects and monitors performance data, allowing users to make, use, save, or sell their power all from their smartphones. Founded in 2006, Enphase has been a critical factor in advancing the solar energy industry. The company introduced the first microinverter-based solar system in 2008 and has grown to become the worlds leading provider. Desertcart is the best online shopping platform where you can buy Price Forecasting Models For Enphase Energy Inc ENPH Stock from renowned brand. Desertcart delivers the most unique and largest selection of products from across the world especially from the US, UK and India at best prices and the fastest delivery time. “KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.”

The Ford F-150 Lightning, a fully electric version of Ford’s hybrid F-150 truck, stores enough energy to function as a back-up power source for a home for three days, or, with energy rationing, for up to 10 days. Revenue guidance for Q came in at $ m, higher than the $690.5m that analysts were forecasting prior to the results, according to Investing.com. Earnings, meanwhile, grew 106.8% year-over-year to $1.51 per share, beating analyst expectations of $1.25 per share by 20.8%. The all-in-one solar energy system gives us a glimpse into what the future of renewable energy use could look like.

More data on US Stocks

On Tuesday,Tesla rival Nio stock and recent IPOC3.ai raced through buy zones. Bitcoin held big recent gains on Tesla’s buy whileGameStop broke below another notable level. Get tailored dashboards built specially for you , based on your set of requirements, to simplify your research workflow. Access thousands of more such key performance indicator data points, on listed companies, with Business Quant.

Its Enphase Energy System brings a high technology, networked approach to solar generation plus energy storage, by leveraging its design for power electronics, semiconductors and cloud-based software technologies. Its integrated approach to energy solutions increases a home energy potential while, providing advanced monitoring and remote maintenance capabilities. Its commercial systems have been deployed in approximately 145 countries. The company’s share price gained 58.1% in the past 12 months, driven by tailwinds such as rising energy prices and the incentives for solar power stocks in 2022’s Inflation Reduction Act . However, in 2023 the stock had fallen 13.8% prior to release of Q4 earnings.

Granular Financial Intelligence

Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests. For best practices on efficiently downloading information from SEC.gov, including the latest EDGAR filings, visit sec.gov/developer. You can also sign up for email updates on the SEC open data program, including best practices that make it more efficient to download data, and SEC.gov enhancements that may impact scripted downloading processes. To allow for equitable access to all users, SEC reserves the right to limit requests originating from undeclared automated tools. Your request has been identified as part of a network of automated tools outside of the acceptable policy and will be managed until action is taken to declare your traffic. Investors preferring a pure-play solar ETF may select the Invesco Solar ETF , in which Enphase is the third-largest holding, with a 6.93% weighting.

All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. Barring Xbox Content and Services, all other segments saw double-digit growth during the quarter. Microsoft’s Intelligent Cloud segment recorded revenue of $16.96B, up 31% Y-o-Y and higher than the consensus estimates of $16.51B.

Enphase Energy, Inc. Equity-NMS: ENPH

Raghu Belur, co-founder and chief intraday buying and selling tutorial officer of Enphase Energy, recently told POWER magazine that consumers’ need to cut household costs could drive residential battery storage to increase at least three times by 2026. Enphase is adding another significant piece to its home energy system, announcing Thursday the successful demonstration of its bidirectional electric vehicle charger. The best part is that it establishes a solar-powered, all-in-one home energy system to give users complete control over their energy. Please read all scheme related documents carefully before investing.

- Enterprise Value is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization.

- Yes, it is absolutely safe to buy Price Forecasting Models For Enphase Energy Inc ENPH Stock from desertcart, which is a 100% legitimate site operating in 164 countries.

- Its commercial systems have been deployed in approximately 145 countries.

With the addition of its latest bidirectional EV charger, Enphase is embarking on a quest to give homeowners complete energy freedom. World-class wealth management using science, data and technology, leveraged by our experience, and human touch. As on 1st May 2023, the traded volume for Enphase Energy, Inc. shares is 7.805 M. Yes, you can buy Enphase Energy, Inc. shares in India by simply opening an account with Scripbox.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. Enphase is already a global energy tech leader, but its bidirectional EV charger unlocks an entirely new segment while unleashing the full potential behind electric vehicles. For one thing, it gives people the option to power their EV with entirely clean energy through its Green charging feature rather than relying on the grid. The Enphase bidirectional EV charger is the next step on our roadmap to building a solar-powered, all-in-one home energy system that further unlocks electrification, resilience, savings, and control for homeowners. Green charging – Enables clean solar energy to be sent to the EVs battery.

The Enphase Energy share price rallied as much as 8.6% in after-hours trading after the company announced an earnings and revenue beat for the fourth quarter of 2022 on Tuesday. The contents on this website have been created in order to ease the customer’s understanding of the subject matter. Enphase Energy has the highest market capitalization in the industry with more than $19 billion.

Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov. This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

The Enphase energy system can instantly detect any power outages and automatically shift from the grid to draw energy from solar, battery storage, or even the EVs battery for uninterrupted power. He added the bidirectional charger will be a “game changer” for those looking for maximum control over their energy. Enphase is currently working with EV manufacturers, regulators, and others to bring the charger to market in 2024.