Brokers work for different industries and are expected to be knowledgeable about the products and services of the company they work for, in order to provide top-notch customer services. Brokers continuously work on relationships with clients, assessing their needs and offering solutions to their problems. The ultimate task, however, is to close deals by aligning the interests of buyers and sellers.

Natural Gas Forecast: Continues to Drift Around – DailyForex.com

Natural Gas Forecast: Continues to Drift Around.

Posted: Thu, 11 May 2023 06:53:34 GMT [source]

This is particularly beneficial if you want to try your hand at commodity futures but you have little to no experience. As such, whether you’re keen on hard metals, energies, or agricultural products – Interactive Brokers has you covered. Perhaps one of the biggest advantages of choosing this top-rated commodity trading platform is that it offers attractive fees. For example, while TD Ameritrade charges a fee of $2.25 per contract, Interactive Brokers allows you to trade from just $0.85 per contract. 68% of retail investor accounts lose money when trading CFDs with this provider. Commodities refers to the material goods that can enter the circulation field, have commodity properties and are used for industrial and agricultural production and consumption in bulk.

Most Common Employers For Commodity Broker

Sign up with us now to begin your trading journey today, or give our demo account a try. CFDs on Commodities are a great way to invest, especially because commodities and stocks don’t act the same way. So if you’re a stock investor and the stock market is being highly volatile, your commodity investments may cover up for that. Once you’re done registering, you can deposit funds and begin your trading journey. Since we’re the best broker with the lowest minimum deposit, you can expect to have a smooth and enjoyable trading experience. Having available customer support makes a huge difference towards one’s trading experience.

They have a really slick account opening process and a simple yet effective platform that has a wide range of commodity markets to trade. In such an agreement, the two parties basically lock a set price and a date to exchange an asset. When you trade futures contracts, bear in mind that these products it carry an obligation. After the futures contract expires, the buyer must receive the assets at the pre-agreed time and price, and the seller has to contribute the desired assets. A derivative is a contract that derives its value from the underlying asset (a share, for example). In our view, eToro is the best commodity trading platform to consider in 2023.

Best for Professional Futures Traders

Both mutual funds and ETFs that invest in commodity futures are typically registered with the SEC as investment companies. They often employ a subsidiary through which futures trading is done, which can simplify tax treatment for investors but also add some complexities. Commodities can add diversification to an investment portfolio and might offer protection against inflation.

So, when the stock market is volatile, investors who trade commodities have a safety net. If you love making money and doing research, an Equity Trader could be a great job for you. Equity traders do research and analysis to determine when to buy or sell shares of a company on the equities market. Duties as an equity trader also may include trading options, futures, and exchanging debt funds and other derivatives. You will need to show a high level of analytical skills, math skills, and detail-oriented skills.

Best Online Brokers for Futures Trading and Commodities

Non-trading fees are charges not directly related to a given trade and typically include the account maintenance fee, deposit/withdrawal fees, and the inactivity fee. The Commodity Futures Trading Commission (CFTC) is the federal government agency that regulates the commodity futures and other commodity derivatives. By contrast, security futures are jointly regulated by the CFTC and the Securities and Exchange Commission (SEC). Commodity futures are most often traded by commercial enterprises that depend on commodities for their business activities. For example, your favorite cereal company might buy wheat futures to secure prices, while an airline might purchase energy futures.

You can also see what percentage of CMC Markets clients are long or short a particular commodity, then filter that by profitable clients to use as a leading or contrarian indicator. Trade over 35 commodities or a range of commodity stocks and ETFs as a CFD or spread bet on spot prices or with (exclusive to IG) an undated contract. Commodity trading spreads are from just 2.8 points on Brent Crude and 0.3 on gold and you can also attach a guaranteed stop to limit your risk, even in the most volatile market conditions.

Fortrade is a broker with a minimum deposit requirement of just $1 while other brokers like eToro and FXCM set a minimum deposit of $50. With a detailed ‘Getting Started Guide’ and an advanced trading platform with ample tutorials, City Index caters to all levels of traders. Markets.com offers five choices of trading platforms, including Marketsx exclusively for real stock trading. If your chosen commodity trading platform does support your preferred payment type, check to see what fees are applicable – if at all. In terms of what commodity futures you can trade, this covers well over 100+ individual markets. For example, you can trade coffee, copper, gold, silver, gasoline, crude oil, feeder, cattle, lumber, soybeans, and even cheese!

Examples of this are investing in the stock of oil companies or agricultural companies. The Tastyworks platform is specifically designed for options and futures trading, with tons of unique features and excellent pricing. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers.com Annual Review. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News. As part of our annual review process, all brokers had the opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy. Brokers also were offered the opportunity to provide executive time for an annual update meeting.

All information on 55brokers.com is only published for general information purposes. We do not present any investment advice or guarantees for the accuracy and reliability of the information. Spreadex was voted by traders for ‘Best for Efficiency of Taking Trades’ in the Investment Trends Awards trade over 20 commodities including Gold from only 0.4pts as a spread bet or CFD. We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The final output produces star ratings from poor (one star) to excellent (five stars).

We have ranked, compared and reviewed some of the best commodities brokers and trading platforms in the UK regulated by the FCA. Most traders use only the phone or the Internet to conduct their commodity trading business and never meet their broker in person. The is especially true for those seeking online discount commodity brokers. It is always an advantage to meet a commodity broker before you open an account, as there are always a few rotten apples in every industry.

Gold Technical Analysis: Gold Price May Remain Bullish – DailyForex.com

Gold Technical Analysis: Gold Price May Remain Bullish.

Posted: Thu, 11 May 2023 10:59:33 GMT [source]

A futures demo account allows you to make trades and track how they would pan out without the risk of losing (or gaining) any real money. Futures trading requires the use of margin, so you typically can’t trade futures in a cash account. If you invest using options, then cash accounts don’t make options trading impossible. There are only a limited number of options-related strategies you can use with a cash account. Tradovate offers a Netflix-like approach to commission-free trading and cloud-based solutions.

Charles Schwab offers reasonably priced futures trading with some other excellent investing features. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. However, using futures contracts, Farmer Mac can lock in the price of corn from his suppliers before the corn growing season even starts. This lets him offset, or hedge, the risk of a difficult growing season that would cause corn prices — and his bovine feeding costs — to spike.

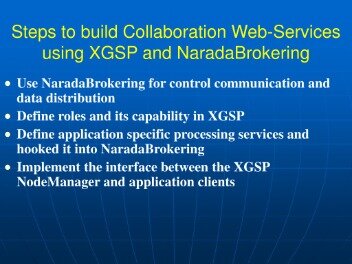

In choosing a broker, serious futures traders must balance low commissions, intuitive platforms, excellent customer service and up-to-date research options. Traders also need charting and screening tools to guide decision-making. This geared exposure is usually for a specific period, like one day or one month, and such products are generally not designed to be held for periods that deviate from that. Anyone who trades futures with the public or gives advice about futures trading must be registered with the National Futures Association (NFA). NFA also offers a number of resources for investors to learn more about how the futures market works and the risks involved.

The provider of the data contained in the Website shall not be liable for any loss incurred by you as a result of your trading activities or reliance on the information contained in the Website. Choose a registered futures Broker who supports the CME Group markets and products you are interested in trading. Quickly filter our extensive broker directory for market specialization, https://trading-market.org/10-best-futures-brokers-for-commodity-trading/ country, language and products. You also want to make sure they have the commodities available that you’re looking to invest in. If a platform only offers a few, or doesn’t include the futures or trades that you’re interested in, you may want to search for another one. Making an investment in a commodity is simple on CMC, which will execute the trade on your behalf.

- Commodity markets include Gold, Silver, Brent and West Texas Crude Oil plus commodity indices, with tight spreads, lightning-fast execution and some of the highest customer satisfaction in the industry.

- They have great educational tools and customer support, meaning it’s a top commodities broker for beginners.

- TD Ameritrade’s margin rates and commissions for futures trading are higher than other platforms focusing more on futures trading clients.

- Signing up with most top brokers takes only a few minutes; after that, you’re free to trade according to your affordability.

You can find advertisements for commodity brokers in trading magazines. The most common commodity and futures publications are Futures Magazine, Stocks and Commodities Magazine, and Stocks, Futures and Options Magazine (SFO). Most brokers will offer to send you free information on markets, to arrange an opportunity to speak with you and get your contact information. The Internet has become the most popular place for many commodity brokers to advertise. You can find advertisements on most futures trading sites, such as INO.com. Yes, futures trading can be profitable and investors may make handsome profits when trading these products.