Contents:

The iShares Factors US Small Cap Value ETF began trading on the New York Stock Exchange under the ticker SVAL on Thursday. The fund screens for value-oriented stocks in the Russell 2000 Index based on liquidity, volatility, leverage and analyst sentiment and then weights securities equally. A Fund of Fund makes investments in its own or other fund houses, as opposed to a typical mutual fund, which invests in specific asset classes. When it comes to foreign Fund of Funds, the fund management makes investments in units of foreign mutual fund schemes.

Pinnacle Financial Partners Increases Stake in iShares Select … – Best Stocks

Pinnacle Financial Partners Increases Stake in iShares Select ….

Posted: Sun, 23 Apr 2023 13:25:08 GMT [source]

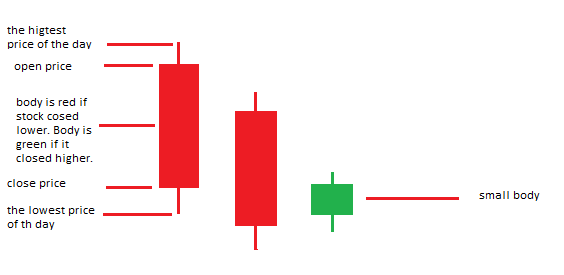

The following graph shows the contribution of FAANG stocks to Nasdaq 100’s performance assuming the allocation had remained at the current level of 30% in the past. In defiance of the lackluster performance, value-focused ETFs have attracted about $10 billion of inflows so far in 2020, according to data compiled by Bloomberg. The renaissance of value has eluded investors for years, though there have been plenty of head-fakes in the past few months. If a user or application submits more than 10 requests per second, further requests from the IP address may be limited for a brief period.

U.S. stocks muted as investors await wave of earnings, including big tech

Launched in 1957, S&P 500 is one of the oldest indices of the US. The index is made up of stocks of the 500 biggest listed US companies. These companies combined represent more than 80% of the total market capitalization of the companies listed on the US stock exchange. Therefore, S&P 500 index can be considered a broad indicator of the US equity markets.

Alpaca https://1investing.in/ LLC, a member of the Securities Investor Protection Corporation, will transmit your orders to the stock exchange and will serve as the custodian for your securities account. In the event that Alpaca Securities LLC fails, and is placed in liquidation under the Securities Investor Protection Act, securities in your brokerage account may be protected up to $500,000. Investing in US stocks through ETFs is much more straightforward for investors looking to get broad exposure to the US markets. You can also access interesting themes like Robotics, AI, Electric Mobility, and Biotech, etc. through ETFs. Although most ETFs have a low expense ratio structures, many have a fee as high as 1%.

Dubuque Bank & Trust Co. Increases Position in iShares 1-3 Year … – MarketBeat

Dubuque Bank & Trust Co. Increases Position in iShares 1-3 Year ….

Posted: Sat, 22 Apr 2023 11:33:28 GMT [source]

Investing in mutual funds for your child’s education is always advisable. First of all, it is a less stressful option than investing in direct equity stocks because that requires you to have in-depth knowledge of market trends and fluctuations. Secondly, with mutual funds, there are a variety of schemes you can opt for depending on a range of factors.

Dow futures tick higher, earnings in focus

By overweighting dividend-heavy industries, DES’ strategy provides a greater dividend yield than the market. Nano and micro-cap corporations are notorious for their fluctuation, and as a result, they are viewed as risky than companies with more significant market capitalization. For firms with larger market capitalizations, stock prices are not always higher than those with lower market capitalizations. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

FAANG stocks account for around 30% of holdings of the Nasdaq 100 index while the allocation to the same in S&P 500 is around 14%. The renewed focus towards technology post the pandemic has supported the earnings growth in the technology companies. These stocks have been disruptors as they have changed the way people shop, work, and entertain themselves. Good earnings growth and a bright outlook ensured the past five years were among the best years for technology stocks in the past decade. The following table shows the CAGR returns of the FAANG stocks over the past 5 years.

Dow futures range-bound as earnings season heats up

Value fund managers are able to identify inefficiencies in these markets. Value funds are typically utilised as allocations for long-term investments that can grow steadily over time. Thus, investment in the value fund is often linked to investment due to diligence and patience. In these challenging times of lockdown and quarantine, everything around us is at a literal standstill, including our stock market. It’s not a surprise that the Indian markets are currently witnessing massive volatility due to the Covid-19 pandemic. Many of us now wish they had diversified their portfolio, or are looking for efficient ways to diversify it now.

Great Valley Advisor Group Inc. Boosts Stock Position in iShares … – MarketBeat

Great Valley Advisor Group Inc. Boosts Stock Position in iShares ….

Posted: Sun, 16 Apr 2023 07:00:00 GMT [source]

The partnership seems to be a part of new Twitter owner Elon… By Yasin Ebrahimd Investing.com — The Dow closed higher on Thursday, as big tech led a sea of green after data showed further sings of cooling inflation and easing labor market tightness… The most significant feature of this selloff has been its breadth. Let us check out the factors that are likely to steer the domestic market through the day. Gains for Joe Biden in vote tallies in the swing states of Wisconsin and Michigan cooled initial selling of renewable energy, marijuana and other companies seen as potential beneficiaries of a sweeping Democrat victory. Axis Mutual Fund officials said that the scheme will invest in ETFs like Xtrackers Nasdaq 100 UCITS ETF, iShares Nasdaq 100 UCITS ETF, and Invesco EQQQ Nasdaq-100 UCITS ETF among others.

IFCM Trading Academy

Nasdaq 100 has significantly outperformed S&P 500 in terms of performance. Over the past 15 years, Nasdaq 100 has delivered a CAGR of around 16%, while S&P 500 has returned about 8%. Although the top holdings include tech biggies such as Apple and Microsoft, the allocation to the sector combined is less than 30%. Companies from the top three sectors together account for around 53% of the index portfolio, which is far lower when compared to Nasdaq 100. Still, Hum expects SVAL to attract interest once economies start to reopen broadly, and points to recent demand for value and small-cap funds.

- IShares S&P 500 Value ETF , formerly iShares S&P 500 Value Index Fund, is an exchange-traded fund .

- Therefore, the volatility in the returns of Nasdaq 100 is likely to be higher when compared to S&P 500.

- By Yasin Ebrahim Investing.com — The S&P 500 struggled for direction Tuesday weighed down by mixed quarterly results and a struggle in big tech.

Theoretically, once these inefficiencies are corrected by the market, the value investor will gain from a share price increase. Quality stocks are also often correlated with dividend payments as they are usually well-established businesses with dedicated dividend distribution programs. Value funds and value investing are often synonymous with strategies developed by Warren Buffett and Benjamin Graham, the notable value investors.

The Nasdaq is usually used as a reference for the Nasdaq Composite Index, which consists of over 2.5K companies. The ETF managed by Vanguard invests in S&P 500 stocks and is appropriate for long-term goals. Its expense ratio is 0.03% making it one of the lowest-cost ETFs in the world. Companies that make up the lowest 25% of the residual market capitalization are taken into account. The S&P SmallCap 600 Underlying Index identifies value stocks with the most vital fundamental qualities, Price book value, and price to earnings ratio, and sales-to-price ratio, from the S&P SmallCap 600.

Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors. Before trading, please read the Risk Warning and Disclosure Statement. Value funds offer a reliable investment opportunity by investing in undervalued stocks.

All content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. The US market is tracked via three major benchmark indices – the S&P 500, the Dow Jones, and the NASDAQ Composite. Here are some major ETFs tracking these indices, through which you can invest in US markets without doing a stock selection. They have higher liquidity, which means the bid/offer spreads are tighter. As it is a yield-focused fund, DES stands out among the slew of US small-cap ETFs.

If you did, please share it with your friends and family and help us reach more people. If you have any questions or you need clarification on what we have written in this blog, do ask us in the comment section below, and we will respond. Launched in 1985, Nasdaq 100 index represents the biggest 100 non-financial companies listed on the Nasdaq Stock Exchange. If you are an institution, click below to learn more about our offerings for RIAs, Hedge Funds, Compliance Officers and more. There are two important things to know about Axis S&P 500 ETF Fund of Fund. One, it is an Exchange Traded Fund , the units can be purchased and sold during trading hours of stock exchnage and secondly, it is a Fund of Fund .

Before trading, clients must read the relevant risk disclosure statements on our Warnings and Disclosures page. Trading on margin is only for experienced investors with high risk tolerance. For additional information about rates on margin loans, please see Margin Loan Rates.

Underestimated can you trademark something that already exists do not look as exciting as growth stocks on the basis of sheer results. The fund managers expect to earn substantial returns from these stocks as their interest is recognised by the market by holding these stocks for a long time. This ETF seeks to replicate two times the daily performance of the DJIA. Investments include securities from the index, derivatives including futures contracts, and money market instruments for short-term cash management. In line with its intention to double the returns as compared to the Dow, the fund has outperformed the benchmark, gaining 68% over the last 12 months. The numbers clearly show that the Nasdaq 100 has significantly outperformed S&P 500 index in terms of return over long term despite witnessing higher correction.

The New Fund Offer of Axis S&P 500 ETF Fund of Fund is currently open and closes on April 5, 2023. The scheme is an open ended fund of fund investing in Exchange Traded Funds replicating S&P 500 index. Vinayak Jayanath would be managing the fund and the minimum investment amount is Rs. 500.

About 60% of trading volumes on the American Stock Exchange are from ETFs. The most popular ETFs are QQQs based on the Nasdaq-100 Index, SPDRs based on the S&P 500 Index, iSHARES based on MSCI Indices and TRAHK based on the Hang Seng Index. The average daily trading volume in QQQ is around 89 million shares.

By Yasin Ebrahim Investing.com — The S&P 500 struggled for direction Tuesday weighed down by mixed quarterly results and a struggle in big tech. By Yasin Ebrahim Investing.com — The Dow ended roughly unchanged on Tuesday, weighed down by mixed quarterly results and a struggle in big tech. Find here information about the iShares S&P 500 Value ETF ETF. You can find more details by going to one of the sections under this page such as historical data, charts, technical analysis and others.

This ETF aims to track the DJUS index and has an expense ratio of 0.20%. It has outperformed the DIA over the last 12 months, gaining 35.15%. This fund has maximum exposure to technology stocks, followed by financial services, healthcare, and consumer cyclicals. The expense ratio of this ETF is 0.16% and the AUM is over $30B. It has gained 30% over the last 12-months, in line with the benchmark index. The majority of the exposure of this ETF is towards financial services stocks, followed by healthcare, technology, and industrials.